1800 child tax credit december 2021

About 36 million families can expect to receive some extra cash beginning on July 15 when the IRS will start distributing the expanded child tax credit. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Child Tax Credit Brought To You By Providers

For example if you have two children under age six you.

. IRS Child Tax Credit Update Portal at irsgov. If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to. Parents can expect more money to come from expanded child tax credit This year.

It means those not receiving the payments for the first five months but who chose and qualified for the December payment may get the full first half of the credit from. Eligible families will receive up to. Families with kids under age 6 can expect up to 1800 while families with kids between the ages of 6 and 17 can expect up to 1500.

July 8 2021 710 AM MoneyWatch About 36 million American families on July 15 will start receiving monthly checks from the IRS as part of the expanded Child Tax Credit. If you and your family are eligible and received each payment between July and December of this year you can expect to receive up to 1800 for each child age 5 or. If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and younger or up to 1500 for each.

If you opted out of the credits entirely. While the monthly advance payments ended in December the tax season 2022 distribute the. According to the IRS families who sign up before the deadline can get all the money they are owed this year in one payment on December 15.

In July the IRS began sending advanced child. The child tax credit payments of 250 or 300 went out to eligible families monthly from July to December 2021. Families can expect their final child tax credit this month in just about two weeks.

People who didnt file taxes in 2020 or 2019 and havent yet claimed their child tax credit through the non-filers tool could be in line for a larger payment of up to 1800 as one. 28 December - England and Scotland only. The final monthly child tax credit payment is due to go out on Wednesday.

Thats potentially 1800 for each child up to age 5 or 1500. Reinstating and making permanent the expanded Child Tax Credit that expired in December 2021. About 36 million American families on July 15 will start receiving monthly checks from the IRS as part of the expanded Child Tax Credit.

Low-income families who signed up before the November 15 deadline will receive all the money they are owed in the December 15 payout according to the Internal Revenue. The notifications went to eligible families mostly low-income people who dont typically file a tax return - who were not already receiving monthly payments. Families signing up now will normally receive half of their total Child Tax Credit on December 15.

The Biden administrations effort expanded the. This means a family can get a. 15 July Age of Child in 2021 Monthly Payment July-December 2021 Lump-Sum Payment 2022 Tax Refund 05 Up to 300 per child Up.

Eligible families under the enhanced Child Tax Credit are expected to receive up to 1800 in payments by the end of December. CASH-STRAPPED families could receive a bumper payment worth up to 1800 per kid today as the IRS sends the final monthly child tax credits for 2021. Eligible families will receive up to 1800 in.

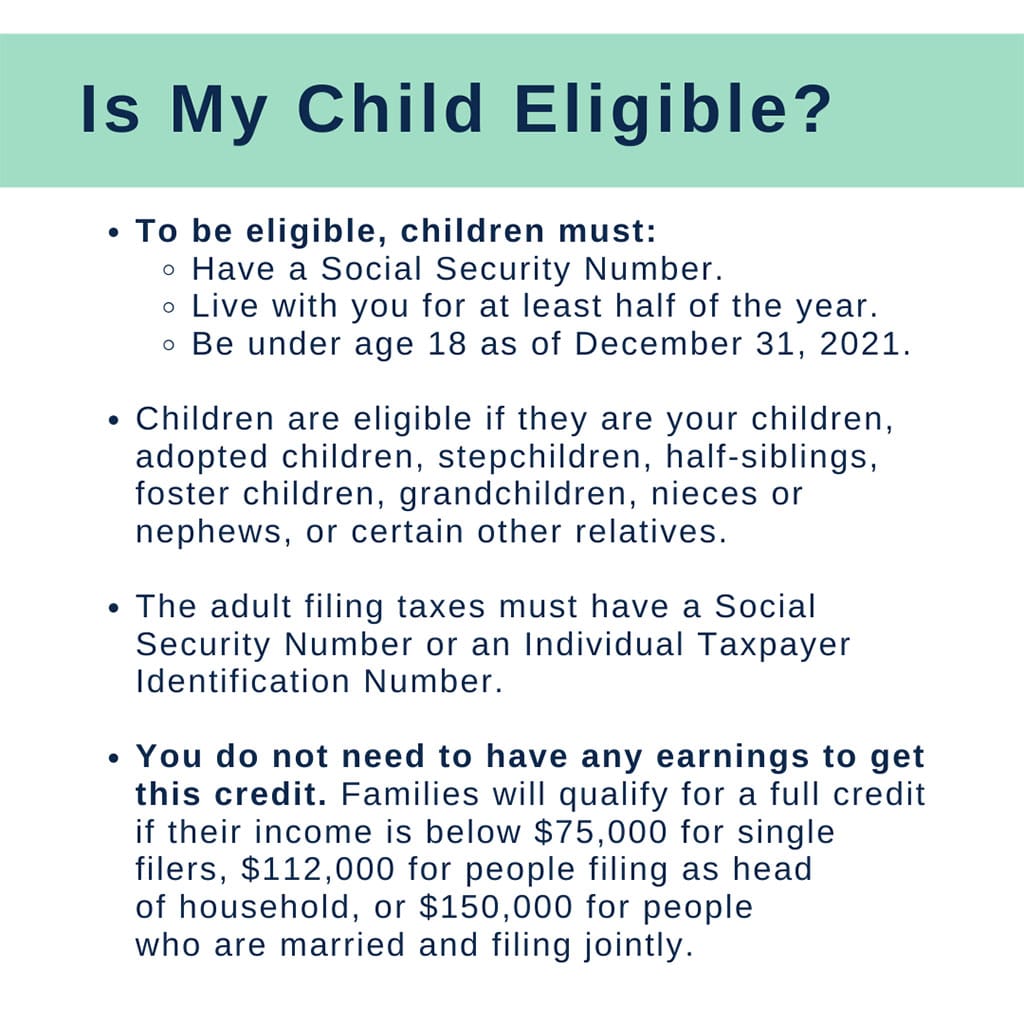

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids. Visit ChildTaxCreditgov for details. Depending on the age of the children some families received.

Some families are expecting 1800 per child. 423 AM CST December 14 2021. Biden noted that the Child Tax Credit cut child poverty in half and reduced.

This means a payment of up to 1800 for each child under 6 and up to. Those who were able to use it in time will get 1800 for each child age under six and 1500 for kids aged six to 17.

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash Wkrc

It S Not Too Late To Claim The 2021 Child Tax Credit

Child Tax Credit Will Monthly Payments Continue In 2022 11alive Com

Padden Cooper Cpa S Remember That The Child Tax Credit Is Optional If You Request It Now You Cannot Claim It Later On Your Taxes For More Help Call 609 953 1400 Childtaxcredits Taxes

The White House On Twitter Tim And Theresa Have One Kid Under 6 For Their Family The Childtaxcredit Means 1 800 In 6 Monthly Installments This Year Another 1 800 After Filing

Irs Is About To Send December S Child Tax Credit Payment January S Depends On Congress Wsj

Stimulus Check Update These Families Could Get Up To 1 800 Per Child In December Wbff

Tax Tips For 2022 Including How To Get More Child Tax Credit Cash

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Child Tax Credit Payment Dates For Final 300 Lump Sum Of 1800 Itech Post

Stimulus And Child Tax Credit Payments You Have 5 Days Left To Claim Your Money Cnet

Frequently Asked Questions On The Child Tax Credit Children S Defense Fund

L A County Department Of Public Social Services Yes It S Free Money And It S Ok Even If Your Income Is Too Low To File A Tax Return You Can Still Qualify To

What Is The Child Tax Credit And How Much Of It Is Refundable

What Are Monthly Advance Child Tax Credit Payments

Next Child Tax Credit Payment Coming This Month

Stimulus Update Some Families Will Get 1 800 Child Tax Credit In December Al Com